What is a Good Faith Estimate

In the loan application process, the loan originator (your lender or broker) at your local Choice Lending Corp office in Downey will need a few items from you. They will ask for your full legal name, Social Security number, gross monthly income, property address, estimate of the value of the property, and the amount of the mortgage loan you want to determine the Good Faith Estimate.

A Good Faith Estimate, or GFE, is a document that includes the breakdown of approximate payments due upon the closing of a mortgage loan. A GFE helps borrowers shop and compare costs of loans with lenders.

Your Social Security number is used to obtain a credit report showing your credit history, including past and present debts and the timeliness of repayment.

,p>The top of page one of the GFE shows the property address, your name and contact information, and your loan originator’s contact information. The Important Dates section of the GFE includes key dates of which you should be aware:-

- You GFE discloses the date and time the interest rate offer is good through.

- I will declare the date “All Other Settlement Charges” is good through. This date must be open for at least 10 business days from the date the GFE was issued to allow you to shop for the best loan for you.

- The interest rate lock time period, such as 30, 45, or 60 days, that the GFE was based on is listed, but does not mean that your interest rate is locked. “Locking in” your rate and points at the time of application or during the processing of your loan will keep the interest rate and points from changing until the rate lock period expires.

- Your GFE will also disclose the number of days prior to going to settlement that you must lock your interest rate.

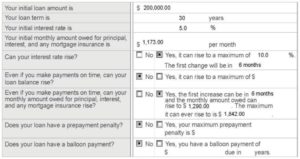

The Summary of Your Loan section discloses your loan amount, loan term, the initial interest rate and the principal, interest and mortgage insurance portion of your monthly mortgage payment. It also informs you if your interest rate can increase, if your loan balance can rise, whether your mortgage payment can rise, and if there is a prepayment penalty or balloon payment.

In example, if the loan amount is $200,000, to be paid over 30 years, with an adjustable interest initiating at a rate of 5%, and the initial monthly mortgage payment at $1,173 -including mortgage insurance, but not including property taxes and homeowner’s insurances- the first time the interest rate could rise, if set to rise at a maximum of 10% it could increase your payments to $1,290. Over the life of your loan the monthly payments could increase from $1,173 to $1,842. This example does not contain a balloon payment or a prepayment penalty.

,p>Note that a prepayment penalty is a charge that is assessed if you pay off the loan within a specified time period, such as three years. A balloon payment is due on a mortgage that usually offers a low monthly payment for an initial period of time. After that period of time elapses, the balance must be paid by the borrower, or the amount must be refinanced.You should think carefully before agreeing to these kinds of mortgage loans. If you are unable to refinance or pay the balance of the loan, you could put your home at risk. If you are ready to talk about what you can afford and what type of loans will fit your needs Choice Lending Corp of Downey can help you explore all the options. Call a lender or mortgage broker today at (877) 777-1203.